The user who has the integration installed will be the only person who can see the invoices in Pipedrive.

#Email outstanding invoices in quickbooks software

Whether you are looking for your business first accounting software or need different but great software, FreshBooks has it all.Note: Only one user per Pipedrive company account can have an active Quickbooks integration at a time. It is straightforward to use, affordable and offers top-notch services without much stress. For instance,īest Alternatives to QuickBooks: FreshBooksįreshBooks is one of the best alternatives to the QuickBooks available for small businesses and freelancers.

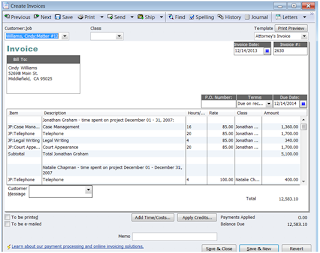

Enter all the required information (minor A/R and A/P charge off) then save and close.Go to the list menu and select chart of account.Follow the steps below to create the charge off account. First, create an account and the item you need to write off the debt.

#Email outstanding invoices in quickbooks how to

How to Use Discounts to Write off Small Amounts Remember, always cross check your account before closing. Choose the apply credit to invoice, check off the bad invoice number and then click on done.

If you don’t have a bad debt item, you have to create one. Proceed to select the bad debt item you want to write off.Input the name of the customer and the date of the invoice you want to write.The credit memo screen will open and follow the step below. Once you have the above information, go to the customer center or menu and select create credit memos and refunds.Information like the customer’s name, the amount owed and the invoice number. Once there, search for the customer you would like to write off and jot down the important information.Click on customers and receivables from the drop-down lists and select "the open invoices" report. Launch your QuickBooks and go to the report menu.No matter how to write off an invoice or how to write off unpaid invoices in Quickbooks, Quickbooks is one of the best invoice software to help you complete. Best Way to Write off an Invoice in QuickBooks However, the step outlined below is the only way you can make adjustments to your sales tax payable account. The ways through which you can write off your invoices in QuickBooks are many. Also, after every effort to retrieve your money has proved futile, the only choice left is to write the invoice off as a bad debt. Unfortunately, it is part of every business to come across customers who refuse to pay their debts.

0 kommentar(er)

0 kommentar(er)