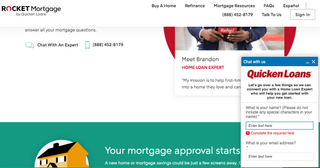

Through Rocket Mortgage, Quicken Loans offers a wide variety of VA loan types. Pros explained Strong selection of VA loan types In addition to this, a single loan officer is assigned to each customer throughout the loan process, which helps streamline communication and paperwork while providing highly personalized assistance. This allows Quicken’s customers to enjoy a level of consistent service that other lenders might not be able to provide. Quicken claims to service 99% of its loans, meaning it does not pass off the customer service and administrative duties to another lender. The company is often ranked in one of the top two positions for customer service satisfaction from multiple J.D. One of Quicken Loans’ greatest advantages is its customer service. Hawaii Alaska Florida South Carolina Georgia Alabama North Carolina Tennessee RI Rhode Island CT Connecticut MA Massachusetts Maine NH New Hampshire VT Vermont New York NJ New Jersey DE Delaware MD Maryland West Virginia Ohio Michigan Arizona Nevada Utah Colorado New Mexico South Dakota Iowa Indiana Illinois Minnesota Wisconsin Missouri Louisiana Virginia DC Washington DC Idaho California North Dakota Washington Oregon Montana Wyoming Nebraska Kansas Oklahoma Pennsylvania Kentucky Mississippi Arkansas Texas Visit Site Best for customer service Although Quicken Loans has a mainly online presence and lacks physical branches, the benefits of their customer service and convenient loan application process more than make up for the lack of physical locations. The company offers a variety of loan types, including VA loans, jumbo loans, cash-out refinance loans, and purchase loans. Rocket's home loan website has earned high ratings for ease of use and responsive customer service.

The company established Rocket Mortgage in 2015 and adopted it as its corporate name in 2021. Quicken Loans created an online mortgage application process and changed our perception of what a mortgage banker is.

Although they require a funding fee that goes directly to the VA, they often have lower interest rates, looser eligibility rules, and don’t require a down payment. Only veterans, active duty service members, and their families are eligible for VA loans. Department of Veterans Affairs that offers more favorable terms than many other types of loans. VA loans are a specialized type of loan guaranteed by the U.S. "Our technology team stood up a website that allows folks to get those answers as well."įarner advises homeowners to "take a deep breath and do the research." He added, "If forbearance is the right thing, and taking a pause in the mortgage payments without affecting your credit makes sense, then that's what we'll do.If you’re looking for a VA loan, Quicken Loans presents an appealing option with competitive interest rates and top-notch customer service. "We've grown our servicing call centers by hundreds and hundreds of people all working from their homes, to take the phone calls, answer the questions," Farner said. Requests to delay mortgage payments grew by 1,270% between the week of March 2 and the week of March 16, and another 1,896% between the week of March 16 and the week of March 30, according to numbers released Tuesday by the Mortgage Bankers Association. Many of the nation's top mortgage issuers, of which Quicken Loans is the largest, are working with clients to help them get through the coronavirus-driven economic halt. But at some time in the future, you have to catch those back up." "Our tool right now is something called 'forbearance,'" Farner said on "Squawk Box." "It gives you the opportunity to pause on making your mortgage payments no impact on your credit.

Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)